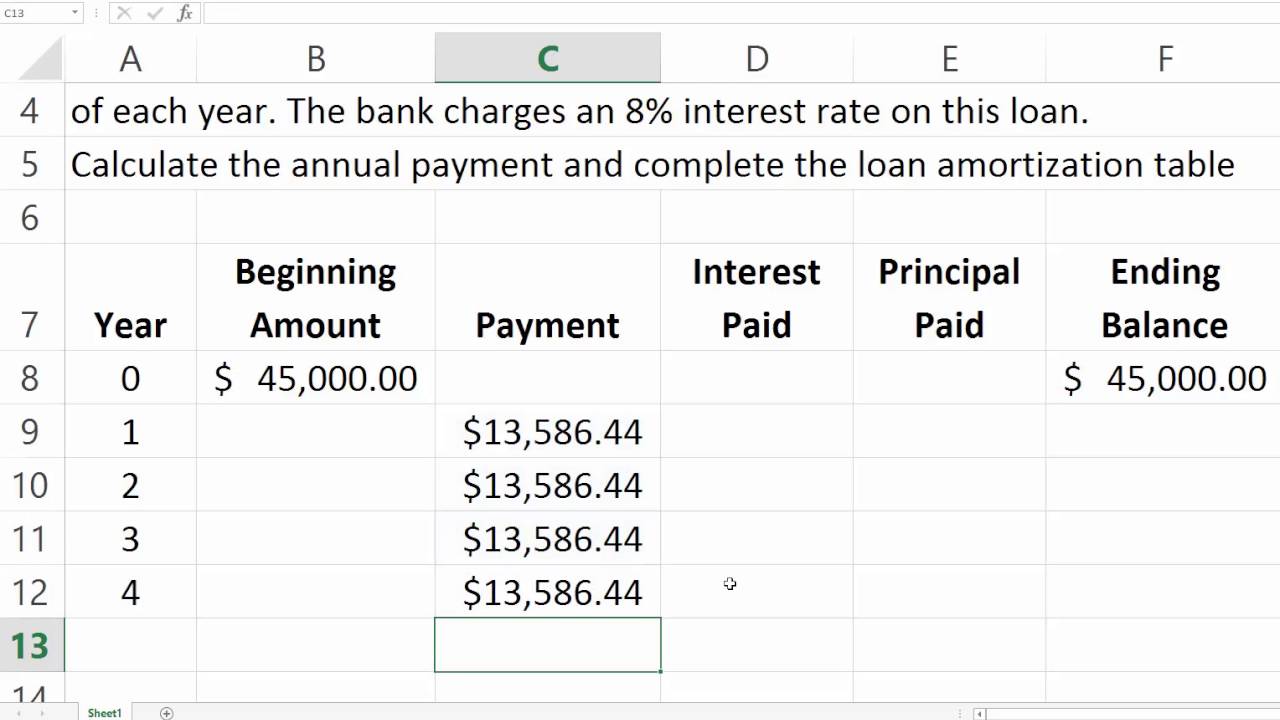

Note: Most closed mortgage products allow a once-per-year lump sum payment of up to 20% of the remaining principal amount or balance.Įxample: if your balance at the end of the year is $100,000, the maximum lump sum payment for that year would be $20,000. This table shows how your mortgage debt decreases over your amortization period. It also helps you see how many of your dollars are going to. ( Image Source) Then it contains an amortization table with information about each monthly payment.

As you can see, it has a few boxes to enter the loan information, such as loan amount and interest rate.

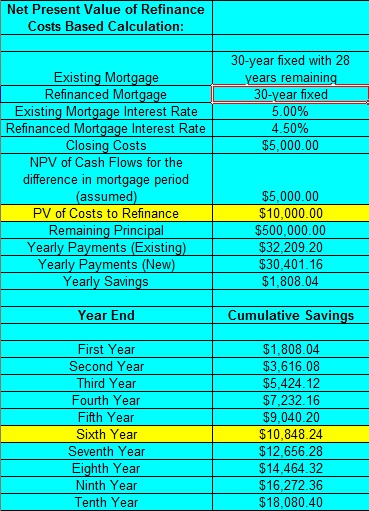

Structure a loan to meet your specific needs. This is Microsoft’s official basic amortization schedule template for Excel. Creates a printable schedule with totals & final balloon payment. Supports extra payments and user selectable dates. If you would like to make a lump sum payment, please select the amount next to the respective year. This all-purpose Microsoft Excel amortization schedule template can be used for a variety of loan types including personal loans, mortgages, business loans, and auto loans. Design a short term loan with a final balloon to lower the regular payment. For instance, if your monthly payment is 1193.54, it’s biweekly counterpart is 550.86. The accelerated amount is slightly higher than half of the monthly payment. The following is a yearly summary of your mortgage payments. In addition, if you use an accelerated biweekly payment plan, you can remove almost 5 years off a 30-year mortgage. To help determine whether or not you qualify for a home mortgage based on income and expenses, visit the Mortgage Qualifier Tool. Mortgage Payoff Calculator (2a) Extra Monthly Payments Who This Calculator is For: Borrowers who want an amortization schedule, or want to know when their loan will pay off, and how much interest they will save, if they make extra voluntary payments in addition to their required monthly payment. The calculator also shows how much money and how many years you can save by making prepayments. Monthly Payments Compared To Other Payment Schedules Schedule This calculator determines your mortgage payment and provides you with a mortgage payment schedule. To try experimenting with lump sum payments, select an amount in the yearly payment summary (above, under Yearly Mortgage Breakdown & Lump Sum Payments).

0 kommentar(er)

0 kommentar(er)